atc income tax india

Welcome to Your Publishing Site. Of years of completion of service.

Oecd S Crypto Asset Reporting Framework Could Be Pivotal For Tax International Tax Review

ATC Income Tax Office is located at.

. 1000 USD although it depends on various factors. 150 Lakh and you end up paying no tax on it at all. Section 80C of Income Tax Act is applicable only for individual taxpayers and.

Atc Income Tax India. B All assesses other than company to whom provisions of section 44AB of the Income Tax Act 1961 are applicable. The limit is capped at 15 lakh aggregate of 80C 80CCC and 80CCD.

Employee Contribution Under Section 80CCD 1. It allows for a maximum deduction of up to Rs15 lakh every year from an investors total taxable income. Any individual or HUF can get a tax deduction up to Rs.

This deduction is not available to partnerships companies and other corporate bodies. This means that your income gets reduced by this investment amount up to Rs. 15 lakh per financial year under Section 80C of the Income Tax Act and its allied sections such as 80CCC and 80CCD.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Tax deducted or collected at source shall be deposited to the credit of the Central Government by following modes. Tirumala Tirupati Andhra Pradesh 517504 India.

A All corporate assesses. You can try to find more information on their website. Insertion of rule 16DD and form 56FF to the Income-tax Rules 1962.

Income-tax Return Forms for Assessment Year 2022-23. Tax Rates DTAA v. All Air Prevention And Control of Pollution Act 1981 Apprentices Act 1961 Arbitration And Conciliation Act 1996 Banking Cash Transaction Tax Black Money Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Central Board of Revenue Act 1963 Charitable And Religious Trusts Act 1920 Charitable Endowments Act 1890.

1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML. A maximum of Rs150000 can be asserted for the financial year 2021-2011 2022-2023 each. Section 80C of the Income Tax Act is the section that deals with these tax breaks.

With over 35 years of industry experience our management team along with our dedicated team of tax professionals has a broad understanding of taxes and their workings. Marissa Drakr 04152020 So for anyone who got there returns in paper for your STIMULUS check was sent to ATC bank account and guess whatNO ONE is ANSWERING the phone at the company. Get Refund Advance up to 6000 1 No Credit Check.

Towards the intention of the mentioned calculation the salary will be rendered as basic salary per month along with the Dearness. Founded in 2004 ATC Financial LLC dba ATC Income Tax offers exceptional tax preparation service and is one of the leading tax service firms in recent years. E The aggregate value of exempt goods or services during the tax period.

Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax. 4003 Durand Ave Racine WI 53405 USA. Certain income of non-resident inter-alia dividend interest royalty or fees for technical services shall be taxable as per the rates prescribed under the Income-tax Act or as per the rates prescribed under the DTAAs whichever is more beneficial to such non-resident.

Perks is yet to be decided. 15 days salary on the grounds of the salary for each finished year of service or the portion thereof in excess of 6 months that is 1526 Salary pm. Over the last seven years the Indian telecom tower industry has grown significantly by 65 with the number of mobile towers increasing from 400000 in 2014 to 660000 in 2021.

150 Lakh are deductible from your income. Address 4003 Durand Ave Racine WI 53405 USA. It states that qualifying investments up to a maximum of Rs.

Reported anonymously by ATC Income Tax employees. CBDT extends last date for filing of Form No10AB for seeking registration or approval under Section 10 23C 12A or 80G of the Income-tax Act 1961 the Act Press Release. 07 Jun 2022 1023 PM IST.

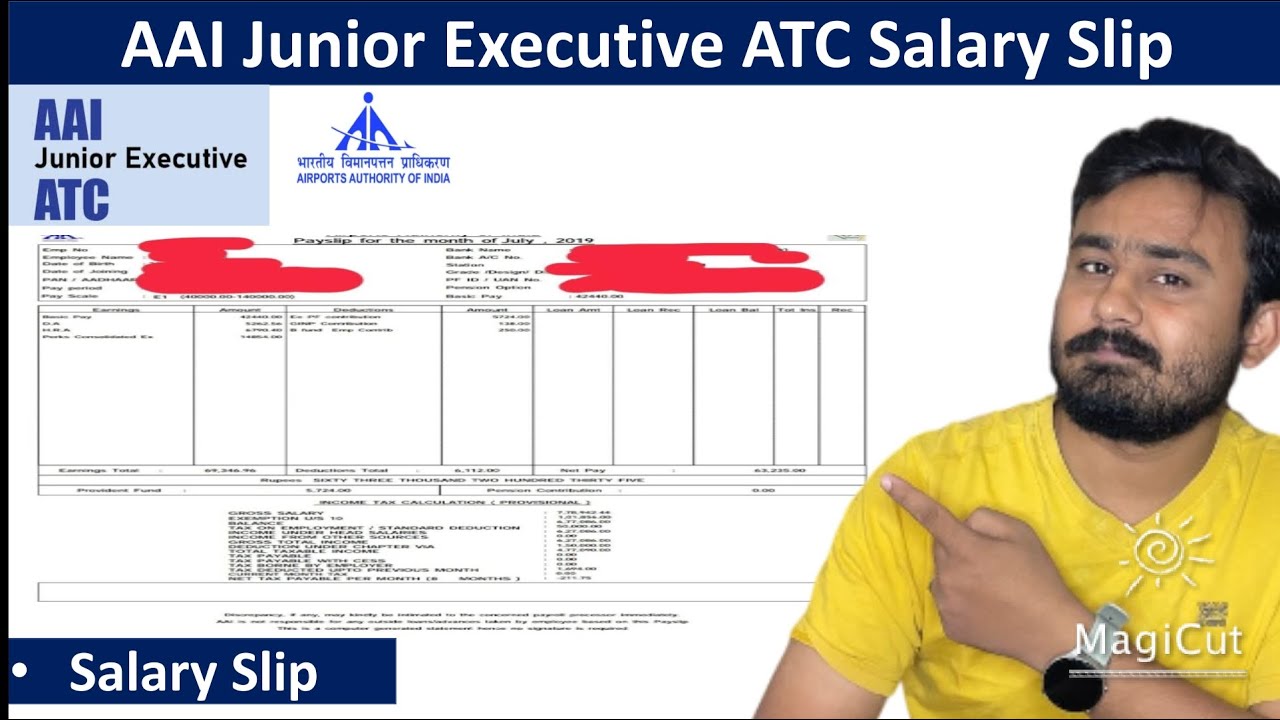

Number of wireless transmission points need to double to serve Indias 5G market. These links will help you get started. The average salary of a JE ATC can be approximated to INR 65000 approx.

D1 the amount of input tax credit attributable to exempted supplies. The amount of the advance 200 to 500 will be deducted from tax refunds and reduce the amount. I will explain all these factors which affect the total salary of any ATC Officer in AAI.

Us 80C you are able to reduce Rs150000 from your taxable income. D1 EF x C2. See reviews photos directions phone numbers and more for Atc Income Tax locations in Indian Creek FL.

As evident from the above table the basic pay of. Tax deductions under Section 80CCD are categorised in three subsections. Section 80C of Income Tax Act is applicable only for individual taxpayers and Hindu Undivided Families.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. A resident company is taxed on its worldwide income. 21 This Act may be called the Income-tax Act.

ATC Income Tax benefits and perks including insurance benefits retirement benefits and vacation policy. Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax. This income tax exemption is allowed to HUF members as well as non-HUF members.

ATC is a premier tax preparation firm with a core focus in tax services. What is the phone number of ATC Income Tax Office. Find your nearest ATC Income Tax offices and make an appointment today.

By furnishing the. Now we will calculate the credit attributable to exempt supplies Ineligible credit by the apportionment of the common credit. 1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML.

E-Payment is mandatory for. A maximum of upto 10 of salary for employees or 20 of gross total income for self-employed individuals. You have to claim this deduction in your income tax.

Air Traffic Controller Salary In India Aai Atc Salary

Taxprep Twitter Search Twitter

Atc Healthcare Philadelp Hia Overview Signalhire Company Profile

What Is The In Hand Salary Of A Newly Recruited Aai Je Airport Operations Quora

Checklist For Indian It Professionals Filing Individual Income Tax Returns Aotax Com

Income Tax Return Filing A List Of I T Rules That Have Changed This Year

Have You Done This Work Related To Income Tax The Center Warned At The End The Indian Nation

What Is The In Hand Monthly Salary Of A Junior Executive Electronics Aai Quora

Budget 2022 Highlights Pdf Free Pdf Download In 2022 Budgeting Income Tax The Borrowers

Aai Junior Executive Salary Slip Aai Junior Executive Perks Allowance Sarkari Naukri Vale Baba Youtube

Safety Boost Aai Integrates Upper Airspace In Ne Region With Kolkata Atc Centre Times Of India

How To Make Atc Certificate What Is Atc Certificate In Gem Atc Certificate In Gem Portal Youtube